pay income tax online

National insurance NI and income tax are changing. Line 4c to increase the amount of tax withheld.

Municipal And School Earned Income Tax Office

Income tax bands are different if you live in Scotland.

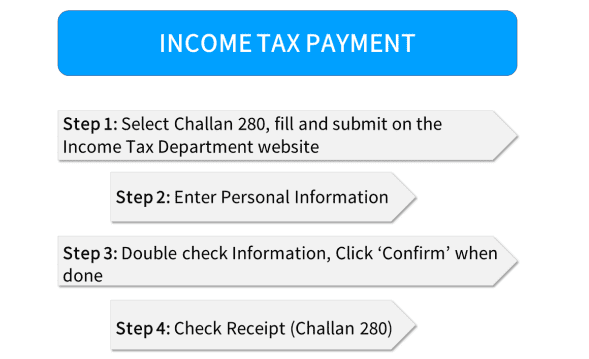

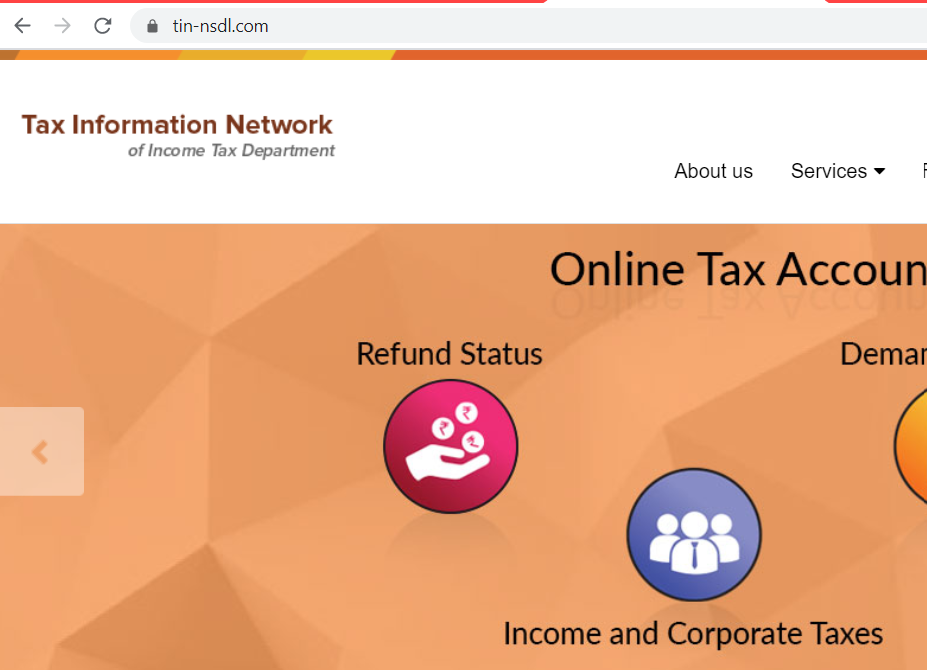

. Check step by step Procedure Things like PAN Verification Calculation Payment Gateway and Receipt of payment. Ohio school districts may enact a school district income tax with voter approval. Contains complete individual income tax data.

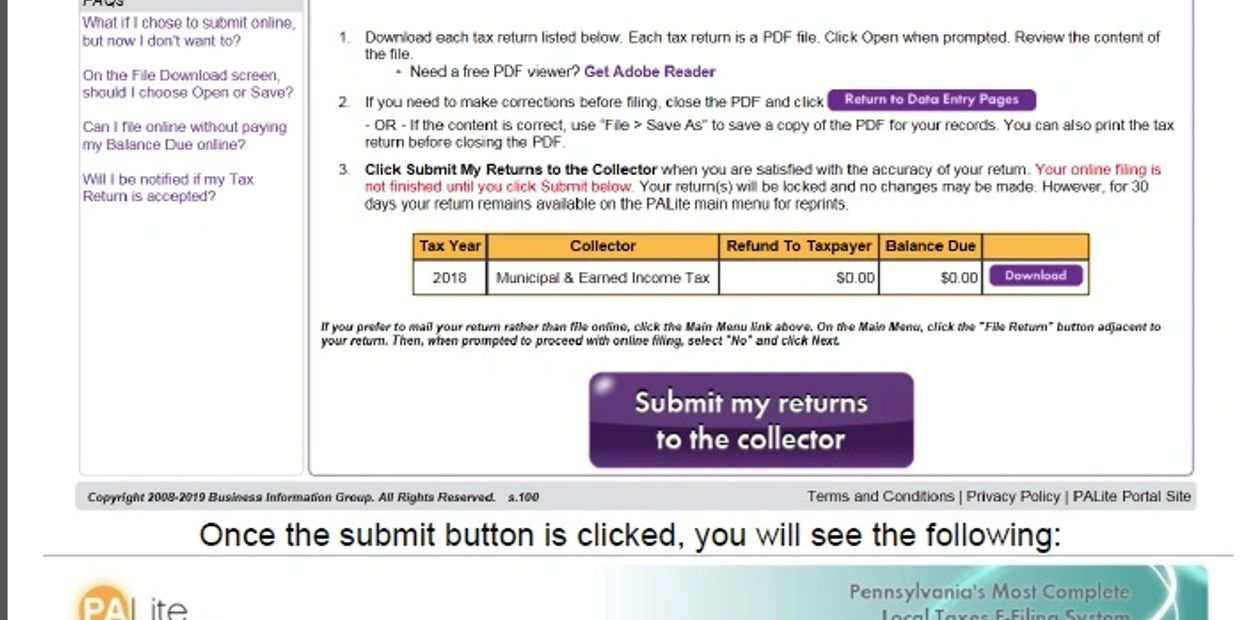

An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft. This Page is BLOCKED as it is using Iframes. You have to fill up the forms and submit them along with a cheque or a demand draft for the tax payment.

TaxTipsca - 2021 and 2022 Canadian income tax and RRSP savings calculator - excellent tax planning tool - calculates taxes shows RRSP savings. ECheck - You will need your routing number and checking or savings account number. Payment with Return - Check or.

This request does not grant an extension of time to pay the tax due. Guide on paying Income Tax which is due. Form IT-489 - Taxpayer Refund Request.

Pay your personal income tax estimated personal income tax extension income tax sale and use tax withholding tax and existing liabilityestablished debt today. Payments received after the return due date will be charged interest and late payment penalty. The second way is to pay the tax online.

Income taxes property taxes and sales taxes. Alabama expects you to pay income tax quarterly if you owed 500 or more on your previous years tax return. You can fill the forms online and make payment through bank transfers credit cards or debit cards.

Make a personal income tax return payment online. Paying Online The Missouri Department of Revenue accepts online payments including extension and estimated tax payments using a credit card or eCheck. Challan NoITNS 282- Payment of Securities transaction tax Estate duty Wealth.

Use if you are 65 to 70 and have elected to NOT pay CPP premiums after starting to collect your CPP retirement pension. Quick Payments using GTC - Instructions State Tax Liens Estimated Tax and Assessments only at this time Paper Forms. Detailed Alabama state income tax rates and brackets are available on this page.

New Users for Online Filing In order to use the Online Tax Filing application you must have already filed a return with the state of Louisiana for the 2004 tax year or later OR you must have a current Louisiana Drivers License or ID card issued by the LA Dept of Motor Vehicles. So beginning in 2020 Form W-4 offers employees four ways to change their withholding. Taxes are unavoidable and without planning the annual tax liability can be very uncertain.

Activity Duty Military with adjusted gross income of 73000 or less will also qualify. Additional time commitments outside of class including homework will vary by student. Guide on paying Income Tax which is due.

The report contains data on sources of income adjusted gross income exemptions deductions taxable income income tax modified. Estimated income tax payments are made to pay taxes on income generated in a given tax year - now 2022 - that is not subject to periodic tax withholding payments as wages are via the W-4 formGenerally if you are an employee whose only income is from a W-2 with taxes withheld you will not have to worry about making estimated income tax. The statistics are based on a sample of individual income tax returns selected before audit which represents a population of Forms 1040 1040A and 1040EZ including electronic returns.

Line 4a to increase the amount of income subject to withholding. Alaska has the lowest tax burden at about 51. 8 Reasons Your Tax Refund Might Be Delayed.

Request a Payment Plan using GTC - Instructions. These four possibilities. As of July 2017 the electronic payment threshold is 5000.

By submitting an extension request you are requesting only an extension of time to file your Louisiana Corporate Income and Franchise Tax return. For the April 2023 income tax change lower 19 basic rate select 202324 for an estimate. Federal Income Tax Calculator 2022 federal income tax calculator.

And line 4b to decrease the amount of income subject to withholding. How to pay electronically through our website individuals only You can pay directly from your preferred account or by credit card through your Individual Online Services account. For new NI changes from Nov 2022 select 202223 Tax Year.

State restrictions may apply. This is a convenient way to pay the tax. Line 3 to reduce the amount of tax withheld.

Challan NoITNS 280- Payment of Advance tax Self-Assessment tax Tax on Regular Assessment Surtax Tax on Distributed Profits of Domestic Company and Tax on Distributed income to unit holders. The Income Tax Course consists of 62 hours of instruction at the federal level 68 hours of instruction in Maryland 80 hours of instruction in California and 81 hours of instruction in Oregon. The first one is the manual process.

If you want to be very tax-conscious you should take into account all the types of taxes you may pay. Clicks are a way to measure attention and interest. Your tax refund comes from your 2021 return and the IRS is required to start paying interest on overpayment 45 days after accepting a tax return.

Click here for a 2022 Federal Tax Refund Estimator. This tax is in addition to and separate from any federal state and city income or property taxes. Pay-per-click PPC has an advantage over cost per impression in that it conveys information about how effective the advertising was.

Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. Welcome to Ohios Regional Income Tax Agency RITA with a website designed to make your municipal tax administration service more easily accessible and navigable online. The Tax Commissioner requires the use of electronic payments of taxes or fees for certain tax programs including income tax withholding if the taxpayer had made tax or fee payments above the designated threshold for that same tax program in a prior tax year.

If the main purpose of an ad is to generate a click or more specifically drive traffic to a destination then pay-per-click is the preferred metric. The Alabama income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Calculate your take-home pay given income tax rates national insurance tax-free personal allowances pensions contributions and more.

Please correct these errors. Challan NoITNS 281- Payment of TDSTCS by Company or Non Company. Click image to enlarge.

WalletHub rates New York state as having the highest total tax burden equal to about 128 percent of income followed by Hawaii at 122 percent. If you would like to make an income tax return payment you can make your payment directly on our website. With forms tools and communication strategies that simplify and increase transparency we are helping individuals businesses and tax professionals navigate the.

The Ohio school district income tax generates revenue to support school districts who levy the tax. Whats new for louisiana 2021 individual income tax. Pay Individual Income Tax Online.

The table shows the tax rates you pay in each band if you have a standard Personal Allowance of 12570. Visit OLTs Free File Alliance offer. As of January 2022 210 school districts impose an income tax.

OLT Online Taxes.

How To Pay Income Tax Online Taxaj

E Tax Payment How To Pay Income Tax Online Mat Sat Youtube

Do I Have To Pay Income Tax On Online Sales Commission

How To Pay Quarterly Taxes Online Or By Mail Shared Economy Tax

Tax Day Laggards Consider Filing For Extension If In A Rush Biz New Orleans

Individual Income Tax Training Department Of Revenue Taxation

How To Pay Income Tax Online In India Finance Guru Speaks The Complete Beginner S Guide To Learn Trading And Investing

E Tax Payment How To Pay Income Tax Online

Income Tax Payment Know How To Pay Income Tax Online Hdfc Bank

Online Income Tax Payment For Taxpayers A Complete Guide Scripbox

Pay Income Tax Online Easily Documents Benefits Navi

If I M Not American And I Sell Stuff Online To The Us Do I Need To Pay Us Income Taxes Htj Tax

Advantages Of E Payment Process For Income Tax Online Payment

How To Pay Illinois Sales Tax Online 9 Steps With Pictures

How To Pay Quarterly Income Tax 14 Steps With Pictures

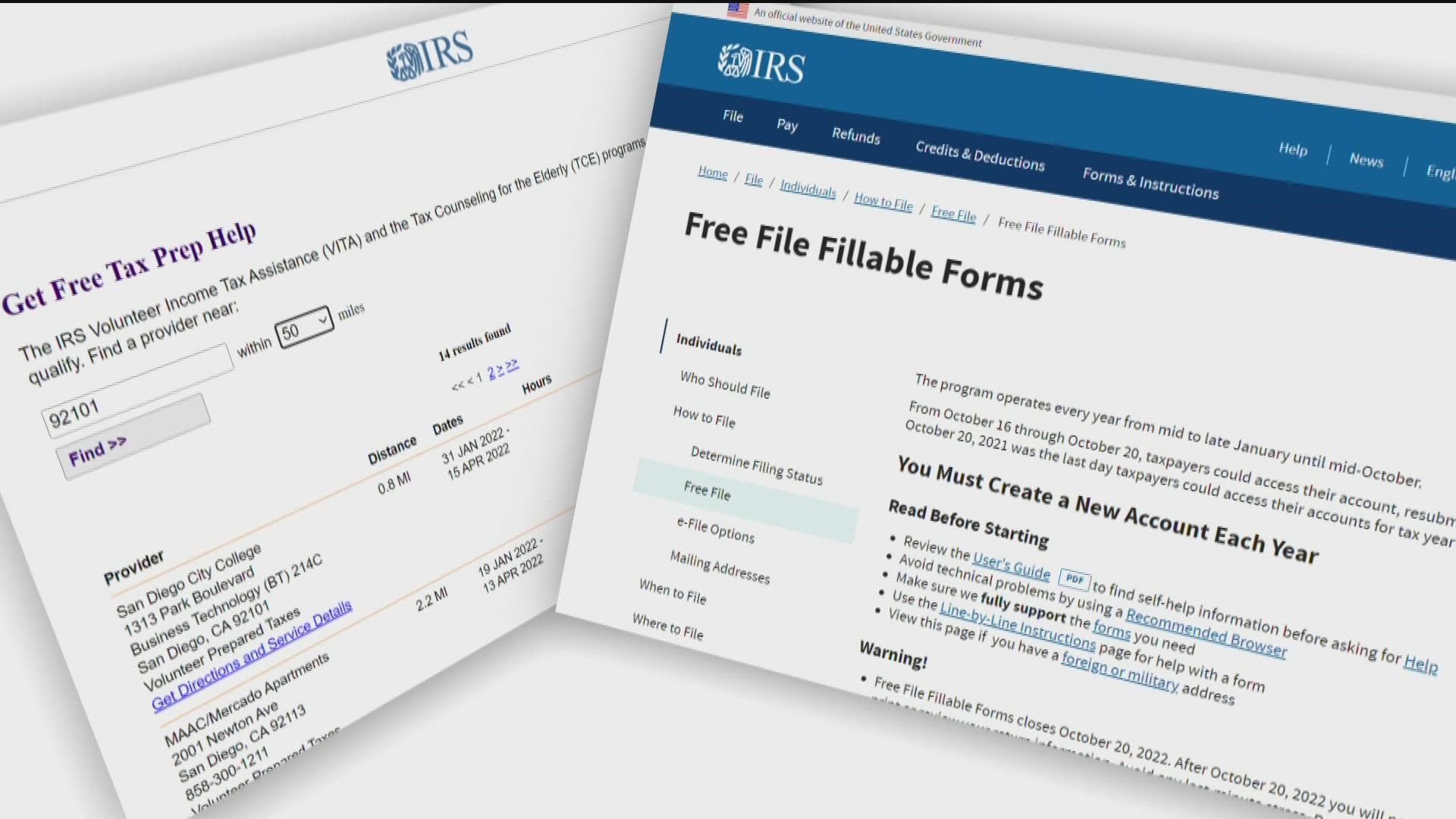

How To File Your Taxes Online For Free This 2022 Tax Season Cbs8 Com

Comments

Post a Comment